Millennials Are on the Move as First-Time Homebuyers [INFOGRAPHIC]

Some Highlights: According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time homebuyers is 32. With more millennials entering a homebuying phase of life, they are driving a large portion of the buyer appetite in the

What is the Best Investment for Americans?

Some are reporting that there is trepidation regarding the real estate market in the United States. Apparently, the American people are quite comfortable. Porch.com, a major network helping homeowners with their renovation projects, recently conducted a survey which asked Americans: “What do

Is A Bigger House Within Your Budget?

At this time of year, many families come together to celebrate the season. It’s also the time when many realize their homes are just not quite big enough to host all of their guests and loved ones. Are you one

It’s ‘National Roof Over Your Head’ Day!

Did you know that each year in the United States, we celebrate “National Roof Over Your Head Day” on December 3rd? As noted on the National Calendar, it was “created as a day to be thankful for what you have, starting

5 Reasons to Sell This Winter

Below are five compelling reasons to list your house this winter. 1. Demand Is Strong The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers

Buyers Are Looking For Your Home [INFOGRAPHIC]

Some Highlights: Existing Home Sales are currently at an annual pace of 5.46 million. The inventory of existing homes for sale remains below the 6 months needed for a normal market and is now at a 3.9-month supply. Inventory remains low due to

Tips to Sell Your Home Faster

When selling your house, there are a few key things you can prioritize to have the greatest impact for a faster sale: 1. Make Buyers Feel at Home Declutter your home! Pack away all personal items like pictures, awards, and sentimental belongings.

The Cost Across Time [INFOGRAPHIC]

Some Highlights: With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low! According to Freddie Mac, rates are projected to increase to 3.9% by this time

How Long Can This Economic Recovery Last?

The economy is currently experiencing the longest recovery in our nation’s history. The stock market has hit record highs, while unemployment rates are at record lows. Home price appreciation is beginning to reaccelerate. This begs the question: How long can

Buyers Are Looking Now. Are You Ready to List Your Home?

Inventory on the market today is low, especially among existing homes in the entry and middle-level tiers of the market. It is hovering well below the 6-month supply typically found in a more normal market, as shown in the graph

Expert Advice: 3 Benefits to Owning a Home

Success is something often worth repeating, and Brent Sutherland, a Certified Financial Planner and Real Estate Investor, has certainly made his way in a momentum-driving direction. Here are 3 tips he shares from a recent piece in Business Insider on

2 Myths Holding Back Home Buyers

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals, “Saving

The Cost of Renting vs. Buying a Home [INFOGRAPHIC]

Some Highlights: Historically, the choice between renting and buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of

Buyer Demand Growing in Every Region

Buyers are out in full force this fall, increasing the demand for homebuying in all four regions of the country. According to the latest ShowingTime Showing Index, “Home showing activity was up again nationwide with a 4.6 percent rise in traffic, as

Homeownership Rate Remains on the Rise

In the third quarter of 2019, the U.S. homeownership rate rose again, signaling another strong indicator of the current housing market. The U.S. Census Bureau announced, “The homeownership rate of 64.8 percent was not statistically different from the rate in the third

75 Years of VA Home Loan Benefits

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also

VA Home Loans by the Numbers [INFOGRAPHIC]

Some Highlights: The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members to help them achieve the dream of homeownership. In 2018, $161 billion was loaned to

Forget the Price of the Home. The Cost is What Matters.

Home buying activity (demand) is up, and the number of available listings (supply) is down. When demand outpaces supply, prices appreciate. That’s why firms are beginning to increase their projections for home price appreciation going forward. As an example, CoreLogic

Millennials: Here’s Why the Process is Well Worth It.

Millennials have waited longer than any other generation to become homeowners, but the wait for this cohort is just about over. According to National Mortgage News, “Millennials, those young adults now aged 23 to 38, are now entering their peak household formation

Planning on Buying a Home? Be Sure You Know Your Options.

When you’re ready to buy, you’ll need to determine if you prefer the charm of an existing home or the look and feel of a newer build. With limited existing home inventory available today, especially in the starter and middle-level

The #1 Reason to List Your House in the Winter

Many sellers believe spring is the best time to put their homes on the market because buyer demand traditionally increases at that time of year. What they don’t realize is if every homeowner believes the same thing, then that’s when

The Difference an Hour Will Make This Fall [INFOGRAPHIC]

Every Hour in the U.S. Housing Market: 614 Homes Are Sold 95 Homes Regain Positive Equity Median Home Values Go Up $1.38

Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage. For many, the mortgage process can be scary, but it doesn’t

How to Determine If You Can Afford to Buy a Home

The gap between the increase in personal income and residential real estate prices has been used to defend the concept that we are experiencing an affordability crisis in housing today. It is true that home prices and wages are two key

Thinking of Selling Your Home? The Waiting Is The Hardest Part.

Tom Petty famously penned the words, “the waiting is the hardest part” in his early 80’s hit song The Waiting, and his thought process can surprisingly also be applied to individuals considering selling their homes today. Traditional thinking would suggest

4 Reasons to Buy a Home This Fall

Here are four great reasons to consider buying a home today, instead of waiting. 1. Prices Will Continue to Rise CoreLogic’s latest Home Price Insights Report shows that home prices have appreciated by 3.6% over the last 12 months. The same report predicts prices will continue

Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC]

Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts to help take

Think Prices Have Skyrocketed? Look at Rents.

Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light

5 Reasons to Consider Living in a Multigenerational Home

Did you know that 1 in 6 Americans currently live in a multigenerational household? According to Generations United, the number of multigenerational households rose from 42.4 million in 2000 to 64 million in 2016. The 2018 Profile of Home Buyers and

Depending on the Price, You’re Going to Need Advice

To understand today’s complex real estate market, it is critical to have a local, trusted advisor on your side – for more reasons than you may think. In real estate today, there are essentially three different price points in the market:

5 Tips for Starting Your Home Search

In today’s market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. Here are five tips from realtor.com’s article, “How to Find Your Dream

Homes Are Selling Quickly [INFOGRAPHIC]

Some Highlights: The National Association of REALTORS® surveyed their members for the release of their Confidence Index. The REALTORS® Confidence Index is a key indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Practitioners are asked about their expectations

3 Reasons This is NOT the 2008 Real Estate Market

Today’s real estate market is nothing like the 2008 market. When an economic slowdown happens, it won’t resemble the last one. No one knows for sure when the next recession will occur. What is known, however, is that the upcoming economic

3 Reasons to Use a Real Estate Pro in a Complex Digital World

If you’re searching for a home online, you’re not alone; lots of people are doing it. The question is, are you using all of your available resources, and are you using them wisely? Here’s why the Internet is a great

Be on the Lookout for Gen Z: The Next Generation of Homebuyers

Gen Zers are the next generation of homeowners, and they’re eager to jump in and buy their first homes. Whether you are part of this generation or any other, it’s never too early to start saving, so you can reach

Existing-Home Sales Report Indicates Now Is a Great Time to Sell

Based on the current state of the market, trends are shifting in favor of sellers. If you are going to sell, now may be the time to take advantage of the number of buyers who are searching for their dream

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Some Highlights: Many buyers are purchasing homes with down payments as little as 3%. You may already qualify for a loan, even if you don’t have perfect credit. Your local professionals are here to help you determine how much you can afford, so

You Need More Than a Guide. You Need a Sherpa.

In today’s world, hiring an agent who has a finger on the pulse of the market will make your buying or selling experience an educated one. In a normal housing market, whether you’re buying or selling a home, you need an

Homeownership is the Top Contributor to Your Net Worth

Recently two U.S. Census Bureau researchers released their findings on the biggest determinants of household wealth. What they found may help shape your view on building your family’s net worth. Many people plan to build their net worth by buying CDs

What FICO® Score Do You Need to Qualify for a Mortgage?

It’s common knowledge that your FICO® score plays an important role in the homebuying process. However, many buyers have misconceptions regarding what exactly is required to get the loans they need. While a recent announcement from CNBC shares that the

62% of Buyers Are Wrong About Down Payment Needs

Contrary to common misconception, a down payment is often much less than many believe. According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market: “More than 6

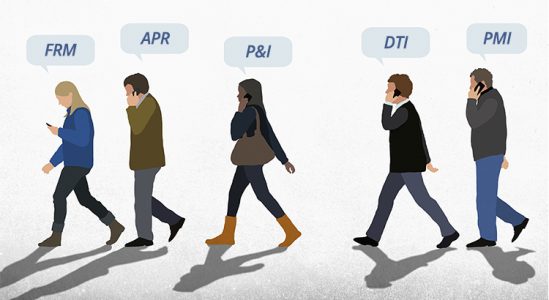

5 Homebuying Acronyms You Need to Know [INFOGRAPHIC]

Some Highlights: Learning the lingo of homebuying is an important part of feeling successful when buying a home. From APR to P&I, you need to know the acronyms that will come up along the way, and what they mean when

3 Signs the Housing Market Is on the Rebound

The residential real estate market has been plodding along for most of the year. However, three recent reports show the market may be on the verge of a rebound. 1. Existing Home Sales (closed sales) are up, marking two consecutive months

4 Tips to Improve Your Home and Save on Your Energy Bill

By making a few key upgrades to your home, you’ll save on your utility bills and improve the energy efficiency of your home. When you’re ready to sell your house, these key features will make it even more attractive to

What to Expect from Your Home Inspection

You made an offer and it was accepted. Your next task is to have the home inspected prior to closing. Agents often recommend you make your offer contingent upon a clean home inspection. This contingency allows you to renegotiate the price

How Does the Supply of Homes for Sale Impact Buyer Demand?

The latest edition of the Realtors Confidence Index from NAR sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand). Until the supply of homes for sale starts to meet buyer demand, prices will continue to rise. The price of any

What Is the Cost of Waiting Until Next Year to Buy? [INFOGRAPHIC]

Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will rise to 3.8%